– Kamal K Kothari and Chitra Chandrashekhar

A key pillar of economic analysis is use of discounted cashflows and present value. Every economics and management student learns these concepts and uses them throughout his or her life. The use of discounted cashflows is a given in any evaluation of cash flows. No one wants to question this cardinal principal-some out of fear of ridicule from challenging the establishment and many more for whom it is something which is ingrained in their understanding that they accept it unquestioningly, and do not see any reason to find any argument to challenge such a core concept.

The authors of this paper also realise the key role played by discounted cash flows in economic analysis and working of the global financial system. This plank has been a key driver in our current global prosperity. But what was relevant in the past needs to be reassessed in the current context of depleting resources including environment resources, available per capita land, fresh water, metal and minerals and fossil-based fuels.

The use of discounted cashflows suffers from the following anomalies which makes their use incorrect, and therefore questionable, in economic analysis in the current environment:

- Use of discounted cashflows boosts wasteful use of limited planetary resources by encouraging profligate consumption.

- Discounted cashflows use incomplete costs-while projected revenues are taken into account many cost components are not.

Encouraging Wasteful Use of Planetary Resources

At the heart of discounted cashflows is the use of exponential function. Change the discount rate slightly and in a few time periods the results are unrealistic. Not many practitioners realise these implications and they value the results obtained as the gospel truth.

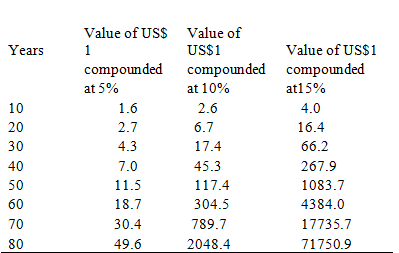

Let’s us take a look at what US$ 1 today would be worth when it is compounded at 5%, 10% and 15% over an 80-year period. We have chosen this time span as human life expectancy is 72 years and in some richer(OECD) countries human life expectancy exceeds 79 years. In Japan life expectancy is over 83 years.

Several interesting observations can be made from the above table. For example, if a parent invests US$ 1 at the birth of a child at 5% per annum when the person is 80 years old he should receive about US$ 49.6. But if the assumed rate is 10% per annum he would receive about US $2049. Invest one dollar at an assumed rate of return of 15% per annum, and the person would receive US $ 71751!!! Returns of such magnitude are not possible in a world of finite resources. But the whole concept of discounted cashflows is based on the principle that money in hand has more intrinsic value than money in future and such a concept encourages us to monetize(consume) limited planetary resources as fast as possible.

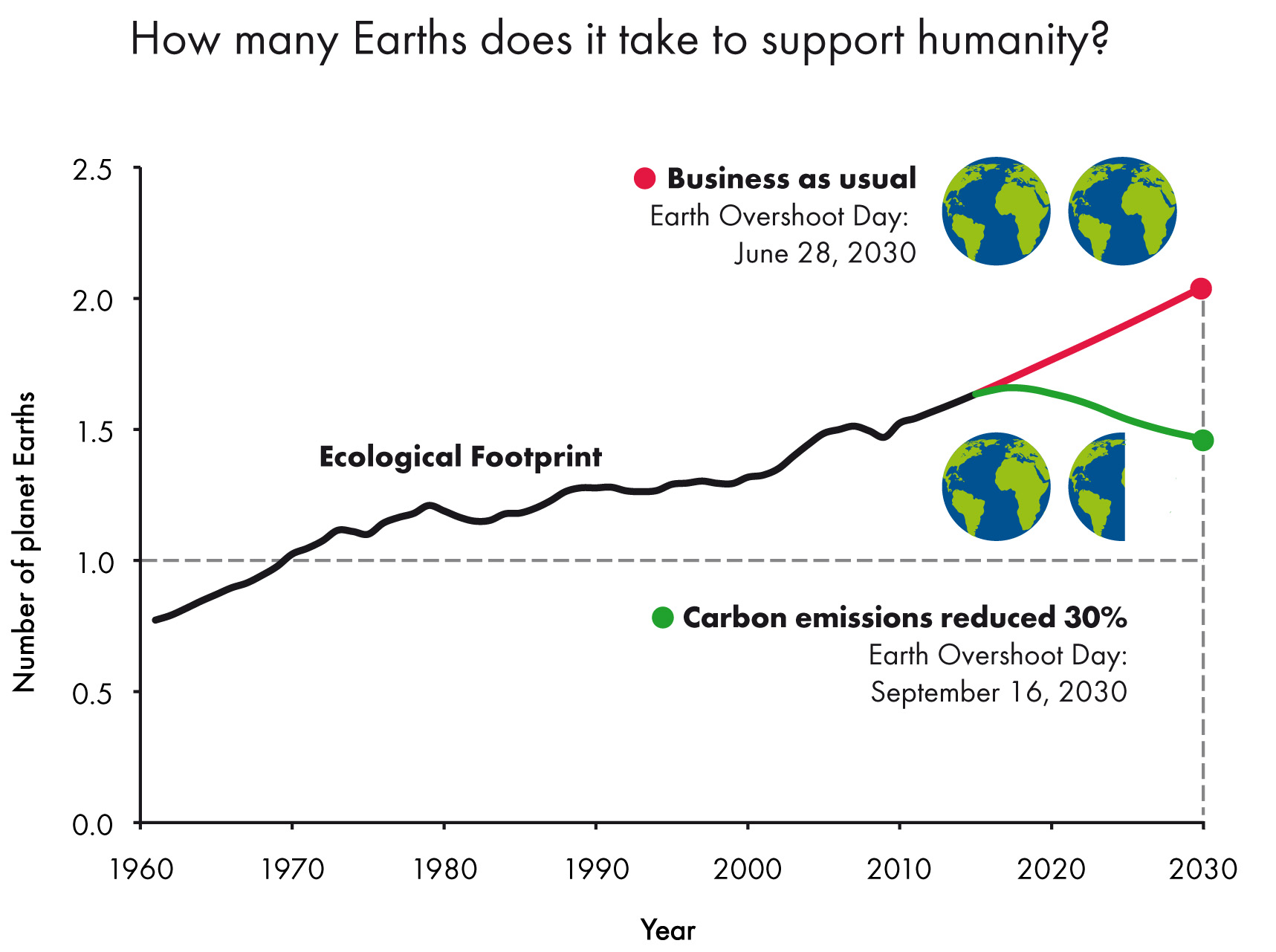

There is another way of looking at this issue. The current Global wealth, as estimated by Credit Suisse is about US $ 280 trillion. If we compound this wealth at a rate of 5% per annum by the time this child becomes an old person of 80 this global wealth would have multiplied almost 50 folds to 13870 trillion!!! Many developed economies grow at 2 to 3% per annum. If we take a 3% growth the global wealth by end of the current century should grow to 3080 trillion (an eleven-fold growth). That can never happen in a finite resource world where the existing resources like oil and natural gas, minerals and metal and above all the environment would be either completed depleted or nearing depletion. For example, even now our consumption planetary resources are far in excess of what we can draw on a sustainable basis. (Please see the diagram below which clearly indicates that if we choose to do nothing by 2030-in just another 12 years – two planet earths will be required to support humanity. An eleven-fold increase in global wealth on the present structure may require 8 planet earths to support humanity-we have only one planet earth!)

But day in and day out we are bombarded with growth models-models with tell often tell us how prosperous we will become in the next 10, 20 or 30 years. Many Nation States, particularly the larger Nation States, have planning bodies which project the level of prosperity of their citizens in future. Similarly, many consultants, some of them global firms, use discounting and compounding techniques to arrive at future prosperity estimates of Nation States without considering the fact that we live on a planet with finite resources. Few who make future projections of this nature ever consider the link between energy consumption and prosperity and how much clean energy would be required to achieve the projected level of prosperity. Similarly, we (the authors) are not aware that while making prosperity projections how food requirements are projected or whether limited availability of land, fertilizers or increasing acidification and temperatures of oceans which reduce their ability to support marine life are factored in.

At another level an individual is lured with messages which promise to handsomely multiply his savings. Advertisements persuade us to invest our savings and receive handsome returns. One of us received a message recently asking us to invest Rs 3000 a month and receive Rs 30 million at the end of the period in addition to a pension Rs 15000 per month. This scheme promises multiply the monies many fold. At the heart of this scheme is the use of compounding technique which multiplies money exponentially. What of course is not told (and perhaps the designers of the scheme do not know) is that when the exponentially multiplied money would be available it would not be backed by adequate resources -global resources are depleting- and hence its value would be very low-in all probability far lower than the initial investment.

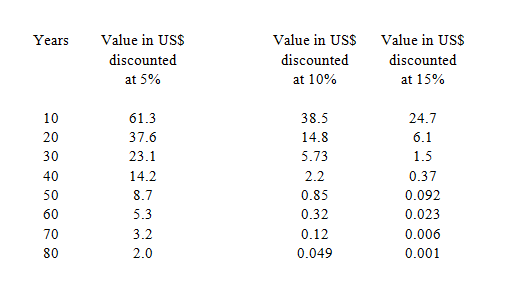

A very insidious implication of compounding and discounting techniques is: profligate consumption. For example, we have one ton of iron ore whose value is say US $ 100. If we use this resource today our economic models teach that we would realise its full value of US$100. But if we do not exploit it today its value keeps on declining with passage of time (the fall in the value being a function of the discount rate-higher the discount rate the greater the fall in the value) as can be seen from the table below:

This model teaches us that the maximum value of iron ore is ‘NOW’. For example, if we use the iron ore after 20 years and the discount rate is 15% its intrinsic value (called present value in economic models) is only US $6.1. After another 10 years (that is in 30 years) the present value falls to US$ 1.5. In 60 years the present value is merely 2 cents and after 80 years the present value is practically nothing These values could be different if the discount rate is different. At 10% the value of the ore would be 5 cents after 80 years. However, if a discount rate of 5% is used the value of iron ore after 80 years increases handsomely to US $2- which is still 50 times less than the value of using it today!!!

What do these economic models encourage businessmen, managers and governments to do? They all simply monetize resources as if there is no tomorrow. ‘Now’ is all that matters. Monetize resources, consume and grow. Be prosperous ‘Now’. Tomorrow does not matter. Many believe or console themselves that tomorrow will take care of itself-after all with ingenuity and innovation human race has thrived for thousands of years. So, they believe that that ‘NOW’ is all that matters.

But we forget that in 2018 we live in a world where its population is the highest ever in its 4 billion year history and almost 4 times more than what it was only 100 years ago. We also live in the most prosperous times in human history. The global GDP in 2017, in nominal terms, is estimated at US$ 77 trillion-in purchasing power parity terms it is estimated at about US$ 127 trillion. Such a high level of GDP is unprecedented in human history. Possibly middle-income citizens of OECD countries live better than many kings who lived just a few hundred years ago. Generating this GDP uses resources at an exponentially increasing rate-in some cases (for example like steel and crude oil)- the current consumption of crude oil is hundreds of time more than the consumption at the beginning of the twentieth century and the steel consumption at least 30 times more. Such a high level of consumption is depleting the planetary reserves at a rapid rate so much so that at current rate of consumption both crude oil and iron reserves will be depleted before the end of the current century. But what do our economic models tell us-consume as fast as you can, any resource left for future exploitation loses value. The implicit assumption behind this thought is that money in hand can be invested to generate more money. And what do our decision makers do? They encourage profligate consumption based on our existing economic models, which not only support this approach but also actually encourages everyone to rapidly exploit finite planetary resources. No one cares if there is less and less is left for the next generation. So dire is the situation that of the key resources like iron ore. crude oil and natural gas will be exhausted in the lifetime of a child born in 2018. Is this the legacy we want to leave for our children? Somehow this question is never asked and if at all the question is raised it is lost in the cacophony of greed.

The case of incomplete costs

The other big lacuna in using discounted cashflows is the use of incomplete costs. Most processes of manufacturing involve directly or indirectly mining, land degradation, emitting water and air borne pollutants, depletion of aquifers and other fresh water sources, destruction of forests, cutting down of trees- the list is endless -in sum total altering the state of the planet. Each industry’s daily contribution to altering the state of the planet is imperceptibly small. But integrate it over all industries and over a long period stretching over a few decades the effect is so large that it has the potential of affecting human existence on the planet. For example, when the industrial revolution started in 1760 the level of carbon dioxide in the atmosphere was 280 parts per million (ppm)-which has now (in 2018) increased to over 403 ppm. Most of this increase has come in the last 60 years or so-from 315ppm in 1958 to the current level of 403 ppm-an increase of 88 ppm. The 403-ppm level of CO2 is, according to some scientists, the highest level in last 800000 years! As of now, with all the existing industrial development program on the anvil, this level will continue to increase. The world, including the richest nations, remain obsessed with economic growth. There is a strong proven link between energy consumption and GDP. Even in 2016 over 85 percent of primary energy came from burning fossil fuel. Although efforts are being made to substitute fossil fuel energy with renewables it appears that in the foreseeable future fossil fuels will remain the principle source of energy to mankind.

The consequences of global warming have been discussed in various fora and it is not our intension to repeat them ad-nauseum. Most climate scientists agree that in the next few decades there would flooding of coastal cities, changed rainfall patterns impacting food production, acidification of oceans and reduced availability of food from the seas and mass extinction of species. When there is mass extinction we have no way of predicting which species in the web of life-including humans-would survive. According to one UN sponsored study climate change could, by 2050, produce up to 700 million environmental refugees who, in our view, will have no place to migrate to in a world jam packed with humanity.

These unpaid costs -the nature of which we have briefly indicated above-do not disappear-they are like an unpaid debt-and will have to be paid by the current and future inhabitants of the planet. With all the uncertainties about the extent of damage our actions are doing and how long (hundreds or thousands of years to reverse these changes) estimation of unpaid costs is a difficult task. How do we price the misery some of our youngsters and their children and build it in our current cost models? If global warming alone, and we are not talking of destruction due to other reasons like land degradation coupled with fresh water depletion and or degradation and consequent reduced availability of food, depletion of other finite replenishable and non-replenishable resources, can cause so much damage that how do we cost our actions whose price will be so large for the future generation that human civilization may collapse under its weight?

The very purpose of economic growth and development is to sustain and nurture us and our future generations. But if economic growth leads to depletion of resources and benefits only two or three generations of mankind in its short history of a few thousand years and the planet’s comparatively longer history of 4 billion years, can such policies be considered good policies? We can put forward the same point in another way. If, for the sake of argument, our ancestors had the technologies which we have and used the resources at the same pace as we do now, what kind of a world we would be living in? We would be living in a resource depleted planet which would be hot, with uneven and unpredictable rainfall patterns, depleted in resources required to sustain an industrial civilization, polluted with industrial wastes which would be spread across land air and water bodies- in fact everything guaranteed to keep our living standards low. But it not a question of living standards alone-the planet earth’s ability to sustain humanity would be much lower. Our current (2018) global population is about 7.6 billion, which according to the United Nations estimates is expected to exceed 9 billion by 2050. But according to James Lovelock, one of the formulators of the Gaia theory, based on current patterns, the ability of planet earth to support humanity would reduce to a few hundred million by 2100. Even if his predictions are farfetched, and planet earth’s ability to support human population reduces, for the sake of argument, to 2 billion humans, how would humanity reduce the global population from over 9 billion in 2050 to about 2 billion in 2100? It is highly improbable that such a reduction in population would be gradual and orderly. In all probability our human civilization would be plagued by food shortages, diseases and civil unrest and all the violence associated with it.

So, how do we cost the death of billions of people in the later part of the current century which is attributable to our actions (or non-action depending how we look at it)? How do we cost the deprivation suffered by countless generations (it may take thousands of years for CO2 levels to reach pre-industrial levels of 280ppm and the depleted non replenishable raw materials would not be available) because of our profligacy? How do we cost the wars which appear inevitable in the pursuit of limited resources as the depletion levels increases? How do we cost the breakdown of the civil society and the civilization as we know? How do we cost the pain felt by billions and billions of humans who will live on a planet robbed by a few generations? Any answer we try to arrive at, if such a computation can at all be made, would be huge and perhaps completely unacceptable to those who can influence decision making and who, if the necessary changes are made for a transition to a more sustainable world, stand to lose their privileges and luxury.

Nevertheless, some attempts have been made to estimate full costs. In a paper published in 2011 in the ANNALS OF THE NEW YORK ACADEMY OF SCIENCES (Issue: Ecological Economics Reviews) titled ’Full cost accounting for the life cycle of coal’ and written by a number of contributors from some of the better-known universities in the United States including the Center for Health and the Global Environment, Harvard Medical School, Boston, Massachusetts and Environmental Science and Risk Management Program, Department of Environmental Health, Harvard School of Public Health, Boston, Massachusetts has estimated that if full costs taken (on the best( mid) cost estimate for the total economically quantifiable costs, based on a conservative weighting of many of the study findings) would add, close to 17.8¢/kWh to the cost of electricity generated from coal in the United States in 2008. The cost of electricity generated from coal was estimated at about 6.5¢/kWh. In absolute term the unpaid cost of 17.8¢/kWh translates to an unpaid amount of US$ 345.3 billion (which incidentally was, in 2010, almost equal to the GDP of South Africa in 2010 and only 28 nations in the world had a GDP more than 345.3 billion) Thus, in effect the real cost of electricity is more than 3 and half times than the nominal cost. Even the authors of that paper believe that ‘Still these figures do not represent the full societal and environmental burden of coal’. In our view these cost figures as estimated in the above referred to paper are very much on the lower side and do not account for all the costs which would have to be paid by the future inhabitants of planet earth. But even for a moment assuming that the cost figure of 24.3¢/kWh is correct, electricity consumers in the United States paid about 7 to 8 ¢/kWh for the electricity used-far less than the true cost of electricity according to the study. Then who pays the difference between the true cost of 24.3¢/kWh and the price paid by the consumer? That is the crux of the problem. Economists refer to these costs as ‘externalities’. And the electricity industry is by no way unique. The problem of incomplete costs applies to practically all industries-be it steel or automobiles or mining or for that matter even industrial farming. With passage of time the unpaid costs summed up over the entire industrial spectrum and the entire world keep on increasing.

Whatever the terminology, the cost has to paid by someone. In reality this cost has to be paid by all the inhabitant of planet earth-rich, poor, young, old and the very young and last but not the least our future generations. The burden is disproportionately shared by the poor, the young, the very young and the unborn. They have to pay for someone else’s consumption. On the other hand, the rich and the very rich are the real freebooters-they, in spite of having all the resources and the capacity, do not pay for what they consume! But the maximum impact of this unpaid bill will be on the youngsters and the future generations who will suffer flooding and famine, inundation of coastal land, social unrest and privation for the profligacy of a small percentage of the rich habitants of the world. Many of these rich and the super-rich are a set whose prosperity is based on stealing-and primarily stealing from our future generations!

That raises some very deep philosophical questions-can the footprint of a few generations on the planet be so large that the survival of human civilization as we know is at stake. And if our economic models like the use of discounted cashflows supports such growth and development which is unsustainable and leaves a huge unpaid bill for the future are they justified? Are we not trampling on the rights of the future generations and denying them a life of dignity which they are entitled to? And if we knowingly continue with these practices how are we any different from those scamsters who borrow from the banks without any intention of repaying such loans? Is this the world we want to leave for our children? For various reasons such questions have never been raised-perhaps because such a situation has never arisen and the kind of problems the world faces today it has never faced before.

Nation States have developed an elaborate set of rules (laws) by which the conduct of each individual is governed. That is a hallmark of civilized societies. In many such societies, and particularly democratic Nation States ‘human rights’ are usually enshrined in their Constitutional documents. For example, in India the Constitution grants certain fundamental rights-right to life, right to equality etc. at the same time casting several obligations upon the State to ensure the wellbeing of the citizen. But there is no law which creates any obligation on the State or the individual for the wellbeing of the future generations. It is taken for granted that humans, like other animal species, would do their best to for the propagation of human species-after all, propagation and survival of the species is a core instinct. Yet as a society we are doing precious little for the well- being of our next generations-either we do not understand the implications of what we are doing or we simply do not care. Do the future generations have no ‘human rights’? Even those of us are somewhat aware of the consequences of our actions are afflicted by the ‘tragedy of the commons’-if everyone else is not doing anything to conserve resources for the future generations whatever I do will not make any difference.

Coming back to the basic question -should we continue to use discounted cashflows? Discounted cashflows form the core of our economic thought-money now is better than money at a future date. Discounted cashflows are the very heart of the banking industry. All projects are evaluated using discounted cashflows. Yet these very discounted cashflows encourage monetization of limited planetary resources at an increasing pace. And the world is poised to run out of these resources in the next few decades-the biggest casualty being the environment. That was not the case even a few decades ago when the resource base was very large in relation to the consumption then. Discounted cashflows suffer from another key drawback-while the current revenues are captured only the partial costs are taken into account. Therefore, the construction of the two sides of the equations are based on flawed premises. The internal rate of return is expected to be a yard stick of ‘capital efficiency.’ But if full costs are taken into account, in most cases, the capital column would be negative-there is no capital left after accounting for full costs, which are not computed and therefore not taken into consideration, and which the economists term as ‘externalities.’ So, if the capital itself is negative, how would discounted cash flows determine ‘capital efficiency’?

Our existing economic models are perfect in world of infinite resources. But we live in a world where resources are finite. If we build ‘sustainability’ in our economic thought and think not of ourselves and ‘Now’ these models collapse. But in a civilization obsessed with instant gratification the existing models serve us well. Nevertheless, if we continue using this approach-depleting limited resources and leaving huge debt for the future generations we would do great injustice not only to our future generations but also to our ancestors who left us a much more pristine and livable planet.

Sorry, the comment form is closed at this time.