Corporate Leadership

Hemant Mundra is the Managing Director at Warburg Pincus. He has worked for 11+ years in Private Equity across varied sectors including financial services, healthcare, consumer relations, and auto components with primary focus on financial services. He is on the board of several companies including Avanse Financial Services, Vistaar Finance, Truhome Finance and Parksons Packaging. Prior to Warburg Pincus, worked for 3.5 years at Kedaara Capital across multiple sectors.

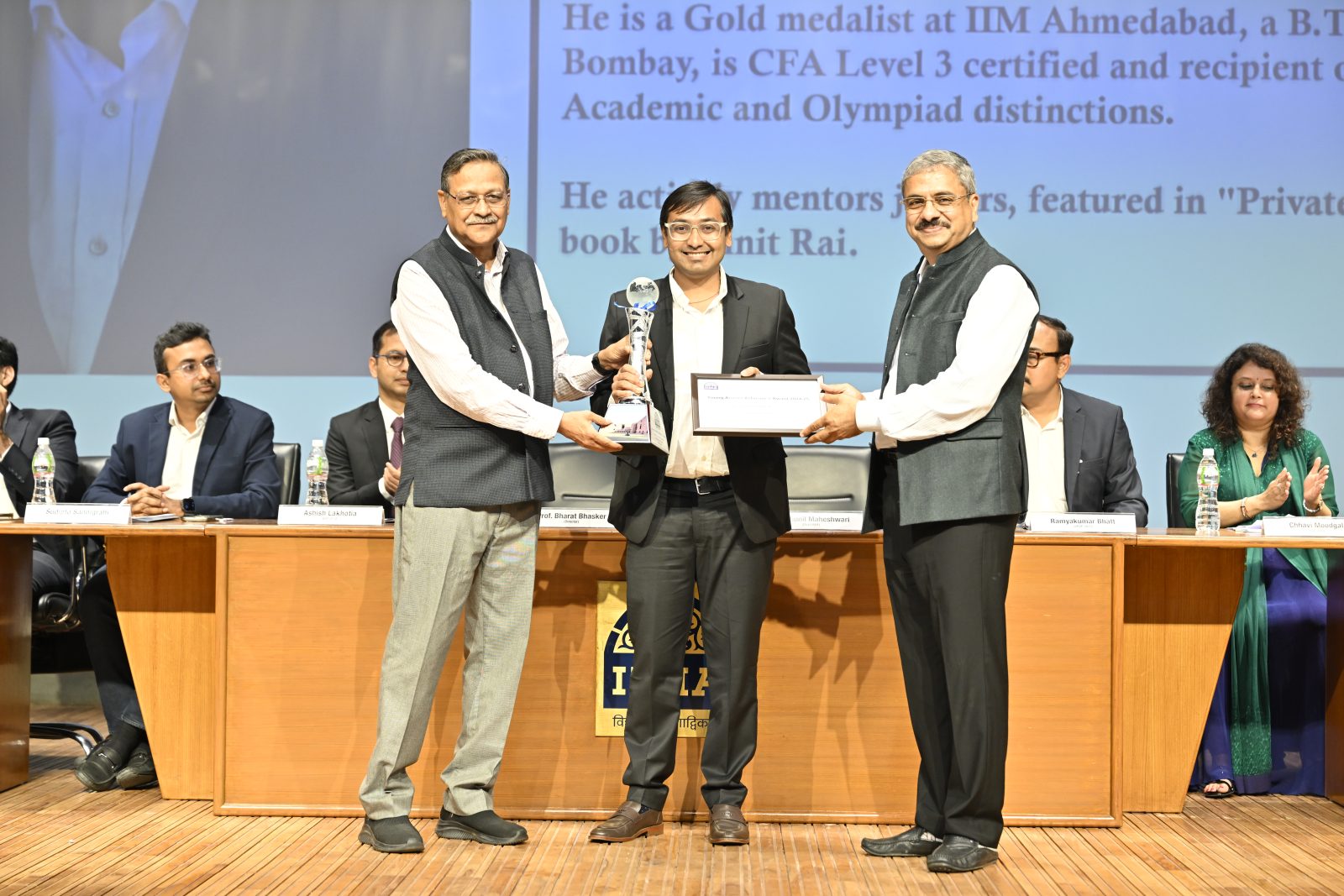

Mr Mundra was Institute Rank 1 (Gold Medalist) for both years at IIM Ahmedabad (2012-2014). He has been awarded Desh Ratna Dr. Rajendra Prasad Gold Medal, Sir Ratan Tata Trust Scholarship, S. Umapathy Prize, S.K. Seth Memorial Award and Smt. J Nagamma Memorial Award for academic excellence.

Mr Mundra did his B-Tech (Chemical Engineering) from IIT Bombay and is CFA Level 3 certified. He was the Gold medalist in National Chemistry Olympiad, among top 1% in Physics Olympiad, 9th in state in Math Olympiad & a CBSE merit scholar.

Congratulations, Hemant, on winning the award. What does winning the Young Alumni Achiever’s Award mean to you?

Thank you so much, and I really feel honored to be recognized by the alma mater as a young alumni achiever. So I am really grateful to the Institute, and thank you for having me. Great to be back here.

As a leader in private equity, what is your approach to identifying promising investment opportunities and supporting portfolio companies through their challenges and growth phases?

A very interesting question, I would say. Everyone has their own different style in investing; the good thing is, there’s no one right answer. But for me, what has worked well is, I have always focused on going deep in identifying the select sub-segments that I like. So let’s say financial services, where I have spent the majority of my time, and I lead our practice for Warburg in India, in financial services. I would say that these are the sub-segments that I like, and that may change over a period of time, right? And then go deep, meet all the companies within that sub-segment and have a point of view ready even before a deal is launched, that allows you to be very razor sharp to say, “This is what I want to do, and this is what I don’t want to do”, because what ends up happening in private equity, lot of people, if you are chasing too many things, you end up not doing anything.

So it’s having a clear focus, and having a clear thesis ahead of time really allows you to make sure that you are able to close the investment that you want to. The other thing that has worked well for me is having your own conviction, rather than a borrowed conviction. If you have your own conviction, if you are able to take bets that others aren’t willing to, I think that allows you to really make good returns if they work out well. It is a positive loop that gets created, and you further back your own capabilities.

I would say, coming to the portfolio side of things, that’s the most exciting part because this is one of the few industries where as a very young professional, you are actually dealing interacting with the CExOs, CEOs. In most scenarios, these are all exceptionally driven individuals but more importantly, they are great leaders who have built teams and companies at a young age, being able to work with them, work alongside them, and have an inside view, and like being interacting right at the top is quite meaningful. So if you’re someone who is like a sponge and can absorb things, you learn and that improves your investing acumen for the next time. That really works well for me. So I genuinely enjoy working alongside portfolio companies, helping them grow. When you do that and when companies scale up, you feel good that over a 5-7 year period, you have created so much employment, you have created a meaningful impact. And when that happens, invariably returns follow.

The other thing that has worked well for me is having your own conviction, rather than a borrowed conviction. If you have your own conviction, if you are able to take bets that others aren’t willing to, I think that allows you to really make good returns if they work out well. It is a positive loop that gets created, and you further back your own capabilities.

Compared to Western countries, how do you think the private equity market in India works, or what are the opportunities here?

I would say we in India are still at the nascent stage. I would say we are probably in phase one, maybe getting into phase two of private equity in India. To put things into perspective, compared to the developed markets like the US, where this industry started in the 1960s, in India, this started in the late 90s. We, at Warburg Pincus, were the earliest ones to enter into Indian private equity market. So we are probably three decades behind. But what I am seeing is US continues to be among the deepest markets, in that sense, where each sub-segment can be very large, and you can build really large businesses. I think India is slowly and gradually getting there. The second thing that we are seeing is that the first wave of private equity investing was largely growth investing, where we only did minority investments, backed entrepreneurs, backed founding families, and effectively grew the businesses and exited. In the last five to ten years, what you have seen is a lot of buyout opportunities. So when I spoke about Avance and how I did 80% stake. Last year, we acquired a business called Sriram Housing, which is now 100%, so predominantly, private equity firms are now acquiring control, backing a professional management team, getting their hands dirty, in that sense. And effectively, that’s the next wave of investing that’s happening. Lot of first-generation entrepreneurs and their kids don’t want to join the business. So that is creating a lot of opportunity, buyout opportunities for funds like us. There’s a massive opportunity ahead of us for the next couple of decades.

What role did IIMA play in your success and work ethic?

I would say IIMA helped me tremendously. I did my undergrad from IIT Bombay, which was a great Institute. I did my post-grad from IIM Ahmedabad. What IIM Ahmedabad does is, firstly, it really disciplines you. It really gives you that sense of purpose. It really makes a good bridge between your undergrad life to your corporate life, wherein you realise the importance of your time management, of how important it is to stick to your basics and the importance of just showing up every day. In IIMA we had multiple quizzes and multiple exams. If you were to be at the best, you have to be best in each. So I think that allows you, gives you that belief that you have to be consistent. I have taken that and I have really learned that that you are only good as good as your last deal, or you were only as good as your last paper back then. So you are hungry for more every day and keep showing up. Also, IIMA being the brand that it is, people always respect you. Some of these core values, once you have that, it actually doesn’t matter which industry, which sector, which geography, globally, if you demonstrate that, you’ll be fine.

What insights would you share with students who are aspiring to join private equity?

I actually was going to an investment banking firm because I had interned there, because private equity firms don’t come to campus, at least back then, they didn’t. So a lot of my seniors and I had heard about private equity because a bunch of my undergrad friends like me, who had first done investment banking, had started working in of private equity. So I had heard that this is an industry that I like at least of whatever I was hearing. But when I spoke to a lot of my seniors at Ahmedabad, they said “You can’t get directly into private equity, do two years of banking or consulting”. But I directly joined private equity. I ended up reaching out to every private equity person on the street, whoever had any common connection, which is like IIMA or IIT Bombay, anything. Most people actually were willing to at least meet. I got one opportunity, and I was able to convert it. Off campus, I got into Kedaara Capital, which is a private equity firm. I was there with them for 3.5 years, and then joined Warburg Pincus eight years ago. The reason I am telling this to every student, to every colleague, friend of mine, what I tell them is, you don’t restrict yourself in your mind, saying that because it hasn’t happened before, it will not happen. You give your best, you try. If you do that, I think the chances are, the odds may be 1 to 100. So 100 people will say no even but if one person says yes, you will be able to get in, because getting into private equity is tough. So my only point is, don’t restrict yourself, reach out to folks, and you will be surprised that more people will be helpful rather than otherwise.

I want to make sure that I give it back to the other folks as well. Once you get in what is required to be in private equity, apart from everything else that I spoke about– is table stakes, but people who have an opinion. There’s no right or wrong answer, unlike math, like looking at the same company, someone is buying and someone is selling. So, having this strong opinion, backed by facts, and being able to get a deal done is the biggest differentiator.

Watch on You Tube: https://youtu.be/aTuTyoM5Mgk?si=7yLZhHRgXvbo1DlZ